With the advent of globalization, technology has progressed and is constantly setting new paradigms. Do you ever wish the internet could accurately determine what you want to discuss through voice, text, or any other medium? Web 3.0 is one such advancement. Web 3.0 is one such step toward independent web browsing, where the content you receive will be modified to your needs, with all irrelevant content eliminated, providing precise outcomes.

Keep scrolling to read the web 3.0 definition, web 3.0 examples, and all its important aspects.

What is Web 3.0?

In simpler terms, Web 3.0 is the next generation of the internet where online applications and webpages seamlessly process data with the help of modern technologies that allow them to respond in a human-like way, making them more realistic and interactive. A perfect example of Web 3.0 can be artificial intelligence, machine learning, and big data.

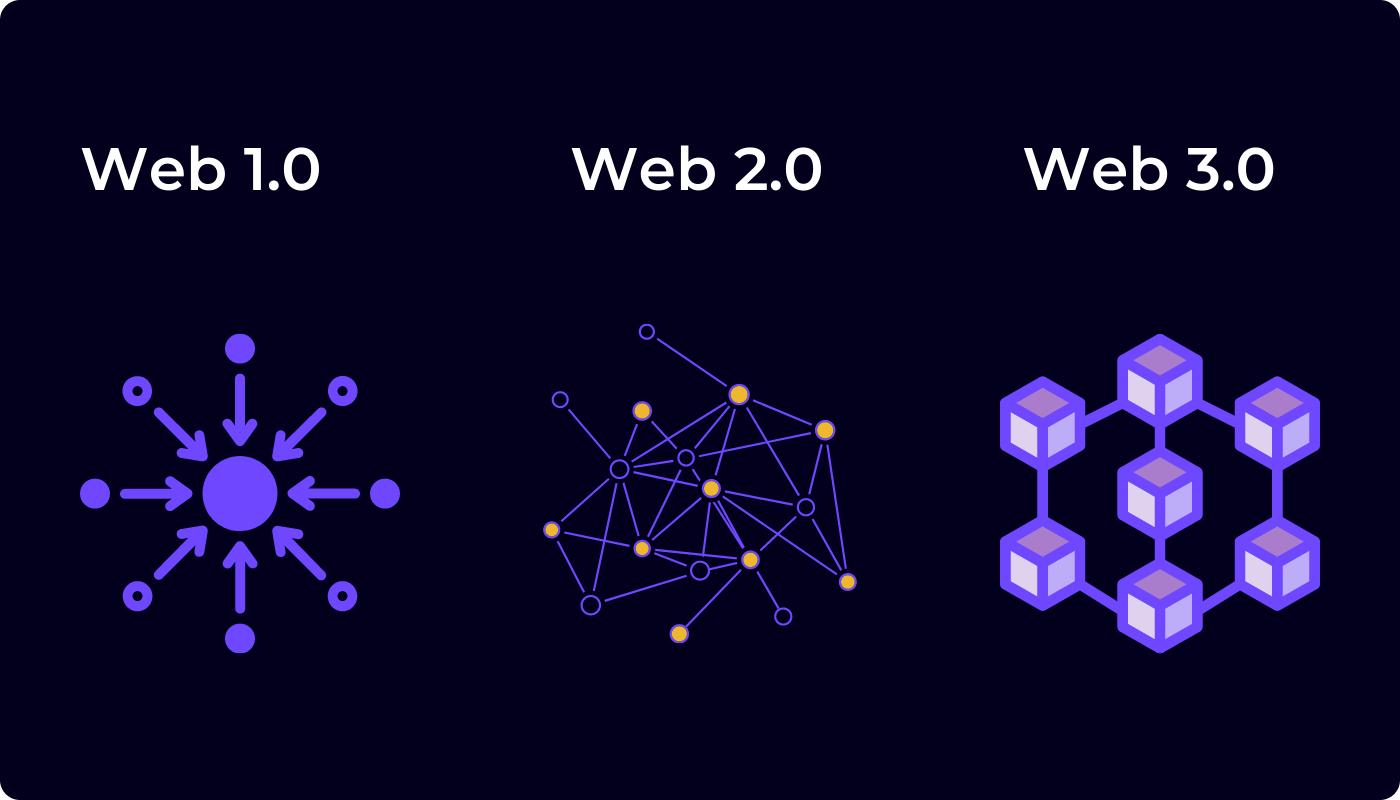

Furthermore, given its autonomous, independent, and intelligent disposition, the originator of the World Wide Web called this project the Semantic Web. Also, it might not be wrong to say that Web 3.0 operates remarkably different than its existing counterpart, Web 2.0. In the existing Web 2.0. version, data is typically held in archives and remains structured more centrally, with separate storage for each data classification.

On the contrary, Web 3.0 strives to make an interrelated basis of decentralized data, resulting in more accurate outcomes. This benefit is that you will only receive information about what you aim for instead of obtaining all other data related to a detailed search.

Also, modern web browsers and devices will be able to understand and interpret data more significantly than ever. Nevertheless, for this to occur, the programs or code entered must comprehend the provided data practically and contextually. It is where Artificial Intelligence (AI) comes to play. The AI is incorporated into programs so that they can analyze data from a new and more useful perspective.

Since Web 3.0 is based on the unique idea of decentralized storage—the same framework used in blockchain development and cryptocurrency—there may be a close association between these technologies shortly, potentially unlocking the possibility of unique technology.

What are the Benefits of Web 3.0?

Web 3.0 is a cutting-edge technology that’s come a long way recently. Here are some advantages of using Web 3.0.

- Better control

The most significant benefit of distributed ledger systems and decentralization in Web 3.0 is that you can track your data and examine the code underlying the mediums you use. Hence the most promising benefit of web 3.0 is it gives you more control and autonomy over your browsing activities by examining the code and determining whether or not the website is legitimate or if there is a threat of a security breach.

When using web 3.0, you will not need to depend on a corporation because there will be almost no organization that works from the back-end. It originates back to the internet’s initial periods and the original ideology of a free and open forum for sharing opinions.

- Increased confidentiality

With the rising number of cyber threats, data infringements, and data theft, it is time for individuals and businesses to think about how they broadcast crucial data online. The blockchain offers a significant advantage in terms of secure access to your data and the capability to monitor it on online platforms and ensure it does not fall into the hands of any bad actors, as online privacy is a matter of grave concern.

- Data Ownership and Distribution

If you are tired of filling out an unending stream of online forms every time, Web 3.0 is here to assist you. With web 3.0, you’ll have a unique profile that works across all online mediums, saving you the hassle of performing the same steps repeatedly. You will also not have to share your confidential data with organizations or other entities only because you will have your profile. You can also choose to share your data and sell it to multiple online brands voluntarily.

- Fewer intermediaries

Decentralization technology functions by removing the intermediaries and linking providers directly with clients. As no middlemen are present, you can always earn better profit from online platforms. Nevertheless, even after using modern blockchain technology, total intermediary negation is impossible because a regulating body is required to monitor and validate. Hence it might not be wrong to say that the world will soon witness a shift from centralized control to a decentralized system in which intermediaries will exist in small numbers, and everything will remain controlled freely.

- Improved motivation for producers

Integrating clients directly with manufacturers makes it more effortless to become a producer. Individuals globally can make investments and find customers directly on Web 3.0 because there are no middlemen or gatekeepers. In addition, distributed platforms and virtual currencies are cutting down national obstacles and social preconceptions. All you require is a great idea and someone who will pay you to execute it.

What are the Use Cases of the Web 3.0 Examples?

The framework for web 3.0 is quite robust. This idea of forming an autonomous entity is already in its early stages. The technology is still in its early stages, but here’s how it’s being- used today:

1. Apple Siri

The modern Web 3.0 is driving the online platforms ahead to the position where manually communicating and searching with the help of fingers will become a thing of the past. Instead, highly-advanced applications like Siri that work on voice recognition software are evolving as futuristic technology. Therefore, it might not be wrong to say that voice recognition software is becoming the fundamental aspect of Web 3.0.

In addition, Siri is the ideal example of Web 3.0, allowing online users to the extent that their devices will be able to interact with each other and offer users better search outcomes.

2. Wolfram Alpha

Wolfram Alpha is a modern computational intelligence platform where you can calculate answers. Moreover, students and working professionals use it in diverse domains like nutrition, mathematics, and science. This online platform employs Web 3.0 by collecting customer data from databases available on online platforms and simplifying the details for end users.

On this website, you can enter any question, which will analyze the question and deliver results suitable to the question asked. For instance, if you type any generic sentence like “two cups of Granola,” Wolfram Alpha will provide you with its nutritional value, calories, and other related details.

3. Experty

Experty is yet another perfect example of Web 3.0 that develops on the borderless nature that drives users people together. In addition, this online platform works on highly advanced approaches to assist individuals in getting professional answers to all their queries. Also, on Experty, you can get better answers through video chat to get better answers to all your queries.

4. Brave Browser

Brave browser is one of the most secure and innovative ways to skim online platforms on any web or mobile device. The primary purpose of this website is to create the safest browser for better data protection with the help of blockchain technologies. Doing this will help limit malicious cyber attacks. Furthermore, this online platform guarantees that this distributed Web 3.0-related system guards users’ confidentiality in the most up-to-date manner possible.

What Will Be the Future of Web 3.0?

Web 3.0 will best simulate and recreate real-world interactions and situations in the coming years. Compare the primary discussion forums to systems like WhatsApp and Facetime today if you can remember them. Even though they connected users globally, these perspectives were restricted regarding what they could distribute and where they could be used. Furthermore, Web 3.0 will provide users with more accurate and truthful search results due to improved data comprehension and interpretation.

Users will also benefit from customized services with apps and other users. Blockchain, Web 3.0, AI, ML, IoT, and other new technologies and abilities are in high demand in the market. Learning these innovations and some skill sets will help students launch a successful tech career. As part of skills training, many EdTech institutions and companies now offer high-end technical programs. In addition, schools and colleges also offer diverse tech-related training programs to help students enhance their aptitudes.

The Use of AI in Web 3.0

AI-powered engines are being used in well-known web applications such as Netflix. Moreover, according to a report, the Netflix Recommendation Engine (NRE) already accounts for 80 percent of all viewing audience activity on the streaming site.

Given their ability to analyze a large amount of customer data and create forecasting analytics individually, machine learning algorithms will most likely be at the heart of Web 3.0 recommendation engines.

Although large social media companies are collecting data from browsing activities to suggest more specific advertisements, it is still not working to its full potential. First, without realizing its actual value, web users have freely agreed to sign off their data to profit-seeking third parties. Second, these businesses’ intrusive data-mining practices have raised pervasive privacy issues among web users.

Web 3.0’s decentralized ethos aims to increase user empowerment by regaining ownership of their information — which can get alternatively transmitted to advertising companies that pay the users directly. However, human content safety classification frequently results in conflicting metadata due to our distinctively various viewpoints, making it one of the most significant challenges of Web 2.0.

Artificial intelligence eliminates human bias, producing more consistent and trustworthy metadata. The quantity of videos uploaded daily far outnumbers human oversight capacity, making video content safety especially important. Nonetheless, thanks to AI algorithms’ massive virtualization, artificial intelligence is expected to transform content safety in Web 3.0.

The Bottom Line

After considering all these points above, we can conclude that Web 3.0 has the potential to create a consumer-driven environment in the future, leading to a more open and secure network. Furthermore, web 3.0 will enable sharing of data and information in a peer-to-peer (P2P) exchange between machines and users.

With the introduction of this new technology, a new era of independent companies with the ability to self-govern and exchange data will begin. It would also alter the connection between users and machines, facilitating secure information exchange, online purchases, etc. Right now, Ethereum is the current leader in the race for web 3.0, as the majority of its foundation is built on web 3.0.

Also, with so many advantages, the future of web 3.0 appears to be bright. This technology would significantly alter how we browse the internet, making it more convenient and goal-oriented.

Instead of going through a slew of random outcomes, web 3.0 will make searching for things on the web quicker. Aside from that, web 3.0 provides a more secure network than web 2.0 because it uses a decentralized method of storing information.